Critical Pricing, PTW & Capture Lessons from the NMMES Protest

An interesting protest decision was released this week by the Government Accounting Office (GAO) regarding the award of the NSWCC Navy Maritime Maintenance Enterprise Solution (NMMES) digital platform contract. The GAO decision underscores several critical pricing concepts and current trends that every Price-to-Win (PTW), Pricing or Capture Manager should understand.

Background, Award & Protest Timeline

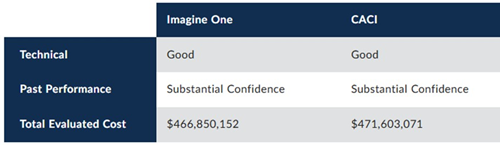

Note: the Total Evaluated Cost / MPC amounts reflect a 5.5-year evaluated period.

Imagine One has been the incumbent contractor on the NMMES contract since 2017. The recompete was initially released in June of 2023.

The 5-year award for $416.5M was originally made in August 2024 to CACI. Imagine One and HII-Alion immediately protested. Following corrective action, the Government made a new award to CACI for $416.5M on July 31, 2025. Imagine One immediately filed a new protest.

Two Critical Protest Arguments

Imagine One’s protest hinged on two primary arguments:

1. Most-Probable Cost (MPC) Adjustments and Indirect Rate Treatment

During the cost realism evaluation, the Government made a MPC adjustment of approximately $22M to Imagine One’s direct labor. The evaluators then applied Imagine One’s proposed indirect rates to the increased direct labor base, resulting in an additional ~$11M upward adjustment in indirect costs.

Imagine One argued this secondary adjustment was overstated. As part of its proposal, Imagine One had provided a spreadsheet model that dynamically recalculated indirect rates based on changes to the cost base. Their proposal and model assumed that winning NMMES would expand the company’s indirect base and drive indirect rates down — a projection that DCAA had deemed acceptable. From Imagine One’s perspective, once the Government increased direct labor by $22M, it should have used that same spreadsheet to recalculate lower indirect rates, rather than simply applying the original percentages. Imagine One asserted that failing to do so overstated its evaluated cost by approximately $3.2M.

GAO shot down this argument, noting:

There was a lack of explicit instructions on how to recalculate the indirect rates in the case of a most probable adjustment.

The Government is not required to make — or likely justified in making — downward adjustments if the solicitation does not explicitly provide for them.

The evaluators acted reasonably by applying the proposed rates to the adjusted base, rather than recalculating the offeror's entire corporate financial model.

2. Alleged Bait-and-Switch

CACI proposed to gradually replace a portion of their staff with less experienced, lower-cost personnel over the period of performance. In a solicitation that mandated a 3.6% escalation rate, this “greening” strategy yielded meaningful long-term savings and reduced CACI’s total evaluated price by $6.7M.

Imagine One argued this constituted a bait-and-switch. GAO disagreed, finding no evidence that CACI lacked intent to execute the proposed staffing plan or that the approach violated the solicitation.

Lessons Learned

Several foundational evaluation and competitive pricing principles emerge from this decision:

Cost Realism Basics: On any cost reimbursable, the Government is required to complete a cost realism analysis. In protests, the GAO will not side with the protestor due to calculation differences so long as the approach the evaluators took is reasonable. A word to the wise: the bar for what is considered “a reasonable analysis” is lower than many offerors assume.

Evaluation is What L & M Say It Is: In two key areas, Imagine One challenged the Government’s evaluation judgments — both of which ultimately turned on how the solicitation defined the evaluation framework.

First, Imagine One’s indirect rate argument hinged on the evaluators making a downward adjustment. FAR 15.404-1 requires a cost realism analysis to arrive at a most probable cost, which can allow for upwards or downward adjustments. The GAO notes that it is dubious that the Government could have made downward adjustments because the solicitation only stated they would make upward adjustments.

Second, Imagine One classified CACI’s greening strategy as a bait-and-switch, claiming they had no intention of doing this. GAO again disagreed, finding that the Government had evaluated the proposed staffing plan as written and reasonably accepted the greening strategy during its evaluation.

Both challenges underscore the same principle: evaluations are governed by the solicitation. The Government must evaluate proposals within the bounds of the FAR and, critically, Section M. GAO does not re-evaluate proposals or substitute its judgment for that of the agency; Rather, it reviews whether the evaluation was conducted in a manner consistent with Sections L and M. This is a recurring protest theme that companies routinely misunderstand — and continue to litigate unsuccessfully.

The Risk of Over-Engineering the Model: Imagine One was directionally correct: increasing the direct labor base should mathematically reduce indirect rates. However, expecting evaluators to dynamically recompute indirect rates after an MPC adjustment is likely a bridge too far. Aggressive assumptions must be fully risk-weighted during PTW and evaluation-risk modeling.

Pricing Levers: Two pricing levers were clearly in play:

Indirect base expansion. Imagine One’s attempt to lower indirect rates by expanding the cost base is a well-established tactic, but one we are seeing with increasing frequency as margins compress across the GovCon market.

Workforce greening. CACI’s phased staffing approach generated $6.7M in evaluated savings and survived protest scrutiny. When transparently proposed, greening is a proven and repeatable pricing strategy — one that often reflects normal execution patterns and can demonstrate deliberate cost control rather than evaluation risk.

Pricing Off Sole-Source Extensions: Imagine One had been operating under a series of sole-source extensions, with the most recent awarded in March 2025 while the protest was still being adjudicated. Contracts transitioning from long-running sole-source extensions often trigger aggressive pricing behavior at recompete — something the cost-type nature of NMMES did not temper.

Using the March 2025 sole-source award as a benchmark, both Imagine One’s and CACI’s MPCs came in approximately 31% below the incumbent fully burdened labor rate (FBLR). Going a step further, Imagine One’s submitted price as the incumbent was even more aggressive — roughly 37% below the sole-source award.

What Was – and Wasn’t – Protested: With a 1% initial price advantage over CACI, Imagine One’s protest was fighting for an additional 2% price advantage (3.1% or $14.7M in total). Notably, Imagine One did not contest the $22M upward adjustment in DL costs. By their own calculation, this should have increased their TEP by $29.8M or 6.2% total cost — roughly 3x what was being protested. They chose to fight for the "scraps”, suggesting the direct labor adjustment was likely indisputable and leaving them to fight a marginal battle they were unlikely to win.

Conclusion

As we’ve noted before, the DoD operates with a different price-to-risk tolerance than most Fed/Civ agencies — but each individual buying office brings its own priorities and risk profile. A winning analysis must account for the specific customer, prevailing macro-economic pressures, and the immediate competitive environment.

In the NMMES case, qualitative scores were nominally equal, though subtle strength differences favored CACI. This leads us to the ultimate "what-if": Would a 3.1% price differential have been enough to flip the award back to the incumbent? We believe we know the answer — do you?

At BlackFlag Advisors, we focus on the intersection of competitor behavior and evaluator decision-making. By modeling competitor cost structures, pricing strategies, and cost realism risk, we help teams forecast awardable price points and position bids to win—not just compete.

Need help understanding your competitive position and fortifying your PTW strategy before the next proposal? Let’s talk.