Understanding Price Elasticity in GOVCON

Introduction

Federal contracting has never been a uniform market. Historically, some agencies chased the lowest cost, while others paid a premium for mission success.

Today, that balance is shifting. Price elasticity — the degree to which evaluators trade value against cost — now varies dramatically depending on budget posture, mission priorities, and contract type. Once relatively predictable, elasticity has become more volatile and uneven.

For contractors, the implication is clear: relying on static Price-to-Win (PTW) assumptions risks being too aggressive where value is rewarded, or too conservative where cost dominates. To compete effectively, elasticity must become a central variable in PTW analysis.

Elasticity Defined for GovCon

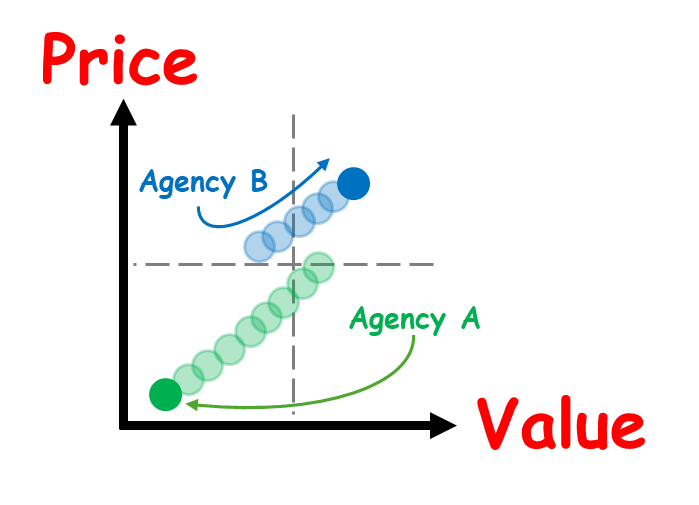

In commercial markets, elasticity measures how demand changes with price. In GovCon, it is less about consumer demand and more about evaluation dynamics:

High Elasticity: Price dominates; even small cost differences can swing the award.

Low Elasticity: Value dominates; evaluators tolerate higher prices if the solution aligns with mission or offers efficiencies.

Recognizing where a procurement falls on this spectrum is essential to setting a winning price.

The New Elasticity Landscape

The volatility of today’s federal market makes elasticity more important than ever. Agencies face pressure to do more with less, contracting offices are understaffed, and competition now includes new entrants and commercial players. The result is greater variability in pricing behavior — and more frequent swings in how evaluators balance cost and capability.

To succeed, contractors must recalibrate PTW for each procurement, considering factors such as:

Agency Funding Posture

Expanding budgets (e.g., DoD, DHS) → lower elasticity. Mission execution and modernization outweigh cost.

Contracting budgets (e.g., USAID, Education) → higher elasticity. Scarcity increases price sensitivity.

Mission Criticality

High-priority missions like nuclear modernization or cyber defense → low elasticity; evaluators accept higher costs for assurance.

Commoditized services like IT helpdesk or staff augmentation → high elasticity; lowest price often wins.

Contracting Office Behavior

Experienced COs defend best-value trade-offs, lowering elasticity.

High turnover or overstretched offices default to cost-driven decisions, raising elasticity.

Contract Type

Firm Fixed Price (FFP): More elastic; evaluation anchors on price reasonableness.

Cost-Plus: Less elastic; realism and technical merit weigh more heavily.

Elasticity in Action

Dynamic PTW models treat elasticity as a core input, not an afterthought. This means going beyond rate benchmarks and wrap-rate assumptions to ask: How will this customer weigh price versus value in this specific procurement?

Scenario 1: A Low-Elasticity Bid

A defense agency with increasing budget authority is modernizing cyber infrastructure. The CO has a track record of complex procurements and is comfortable defending trade-offs. Here, contractors can hold pricing closer to true costs, with evaluators more likely to pay a premium for innovation and assurance.Scenario 2: A High-Elasticity Bid

A civilian agency facing budget rescissions recompetes a staff augmentation contract. The CO is inexperienced and under pressure to cut costs. Even marginal price differences may decide the award. PTW must identify the competitive floor — and test whether margin sacrifices are strategically sustainable.

Conclusion

The GovCon market in 2025 is not defined by uniform rules. It is a mosaic of shifting elasticities, where the same company may need to compete as a cost leader in one bid and as a value innovator in another.

Contractors that integrate elasticity into PTW gain a decisive advantage: the ability to place bids where evaluators view them as both compelling and defensible.

At BlackFlag Advisors, we help clients map elasticity, quantify risk, and build dynamic PTW models that align with the customer’s evaluation lens. In an era where price matters differently across procurements, precision is the ultimate competitive edge.

Reach out today to explore how elasticity-aware PTW strategies can sharpen your captures.