Competitive Intelligence

We help our clients see the field before the game begins — and position themselves to win it. Our competitive intelligence services give you more than surface-level snapshots; we deliver structured, impartial insight into the market, the competitors, and the customer’s priorities.

Whether you're entering a crowded IDIQ, pursuing a must-win recompete, or trying to break into a new market, we give you the intelligence to anticipate how competitors will position — and how you should respond. We combine open-source research, financial modeling, past performance analysis, and technical strategy assessment to build clear, actionable profiles of your rivals and the environment you're competing in.

From Black Hat facilitation and pipeline generation to competitor landscapes and assessments, our support helps you identify your strengths, exploit gaps in the field, and drive confident bid strategy.

Explore our suite of competitive intelligence offerings to see how we can help augment your capture strategy, market positioning, and pursuit readiness. Have a unique requirement? Get in touch — we can tailor an engagement to meet your specific objectives.

Market Studies

Our Market Studies provide deep-dive analyses for companies looking to expand into new service areas or customer segments. These tailored assessments evaluate market size, competitive landscape, government buying trends, and customer behavior—delivering strategic insight into where, how, and with whom you’ll be competing. Ideal for strategic planning, new market entry, or corporate growth initiatives.

Pipeline Generation

We build targeted, opportunity-specific pipelines designed to align with your strategic priorities and core capabilities. Leveraging proprietary research and leading federal data tools, our team identifies upcoming contract opportunities and creates structured pipeline frameworks to fuel your BD and capture planning efforts.

Black Hat Support

Our Black Hat services include comprehensive competitive intelligence read-aheads, expert facilitation, and subject matter expert (SME) participation. Whether you're looking for an external moderator, pre-read packages, or SME support, we support your team in understanding how competitors will position—and how you should counter.

Competitor Profiles

Competitor Profiles are subscription-based intelligence products delivered annually with quarterly updates. These in-depth profiles track the strategy, performance, and positioning of your top competitors over time. Each profile includes analysis of recent contract wins and losses, M&A activity, market expansion efforts, organizational shifts, financial benchmarks, and updated wrap rate models.

Designed to support proactive decision-making, this product helps clients maintain situational awareness and respond strategically to changes in the competitive landscape.

Opportunity Landscape & Competitor Assessments

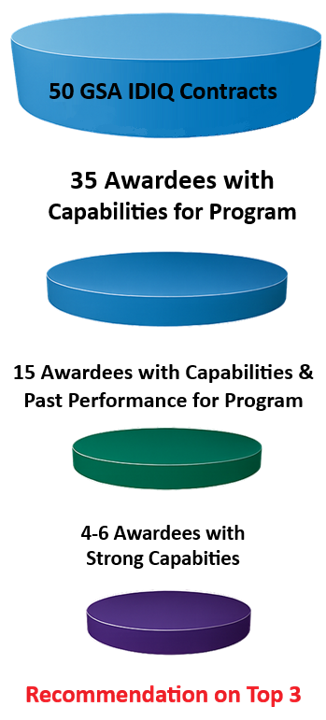

These modular, opportunity-specific analyses provide a comprehensive understanding of the competitive field and can be commissioned either independently or as an integrated suite:

Opportunity Landscape: Broad scan and down-select of all potential bidders—including known primes and dark horse candidates—culminating in a focused list of likely competitors, each analyzed for fit, capability, and risk posture.

Competitor Assessment: In-depth evaluation of a specific bidder’s positioning for a given opportunity, including SWOT analysis, teaming strategy, past performance alignment, technical gaps, value proposition, and mock evaluation scoring.

Self-Look Assessment: A mirror of the competitor assessment, applied to the client’s own solution. This diagnostic evaluates how outsiders view your strengths, weaknesses, and score-ability — forming a foundational element of our Price-to-Win recommendations.

Together, these assessments provide the analytical foundation for a well-informed Price-to-Win recommendation—but each can also be performed as a standalone deliverable based on client need.

Mergers & Acquisitions

Our M&A support helps clients identify strategic growth targets through focused gap analyses and market landscape scans. Whether you're evaluating capability gaps or assessing new customer channels, we identify high-value acquisition candidates aligned to your objectives and deliver clear, data-driven insight to inform due diligence, valuation, and integration strategy.