Wrap Rates

As today’s procurement landscape tilts toward fixed-price awards, companies are reexamining every element of their cost structure — and wrap rates are front and center.

With revenue pressure rising and evaluation criteria favoring price over promise, the ability to accurately model competitor indirect structures is no longer a luxury — it's a competitive necessity.

Precision Forecasts. Transparent Assumptions. Trusted by Capture Teams.

BlackFlag Wrap Rates go deeper.

Unlike generic multipliers or opaque benchmarks, our forecasts are built by credentialed finance professionals with decades of experience supporting billion-dollar bids across the DoD, IC, and civilian sectors.

Each model is tied to actual CAGE code financial behavior — analyzing fringe, overhead, G&A, and fee — to deliver a realistic view of your competitors’ cost posture.

You’ll receive:

Detailed wrap structure breakdowns by CAGE code

Assumption transparency and source traceability

Competitive insight aligned to real-world pressures

Wrap Rates

Precision Forecasts. Transparent Assumptions. Trusted by Capture Teams.

As today’s procurement landscape tilts toward fixed-price awards, companies are reexamining every element of their cost structure — and wrap rates are front and center.

With revenue pressure rising and evaluation criteria favoring price over promise, the ability to accurately model competitor indirect structures is no longer a luxury — it's a competitive necessity.

BlackFlag Wrap Rates go deeper.

Unlike generic multipliers or opaque benchmarks, our forecasts are built by credentialed finance professionals with decades of experience supporting billion-dollar bids across the DoD, IC, and civilian sectors.

Each model is tied to actual CAGE code financial behavior — analyzing fringe, overhead, G&A, and fee — to deliver a realistic view of your competitors’ cost posture.

You’ll receive:

Detailed wrap structure breakdowns by CAGE code

Assumption transparency and source traceability

Competitive insight aligned to real-world pressures

Wrap Rates

Precision Forecasts. Transparent Assumptions. Trusted by Capture Teams.

As today’s procurement landscape tilts toward fixed-price awards, companies are reexamining every element of their cost structure — and wrap rates are front and center.

With revenue pressure rising and evaluation criteria favoring price over promise, the ability to accurately model competitor indirect structures is no longer a luxury — it's a competitive necessity.

BlackFlag Wrap Rates go deeper.

Unlike generic multipliers or opaque benchmarks, our forecasts are built by credentialed finance professionals with decades of experience supporting billion-dollar bids across the DoD, IC, and civilian sectors.

Each model is tied to actual CAGE code financial behavior — analyzing fringe, overhead, G&A, and fee — to deliver a realistic view of your competitors’ cost posture.

You’ll receive:

Detailed wrap structure breakdowns by CAGE code

Assumption transparency and source traceability

Competitive insight aligned to real-world pressures

In a high-risk, price-sensitive environment, clarity is a weapon.

BlackFlag shows the work.

So your team can defend every estimate — from Black Hat to BAFO.

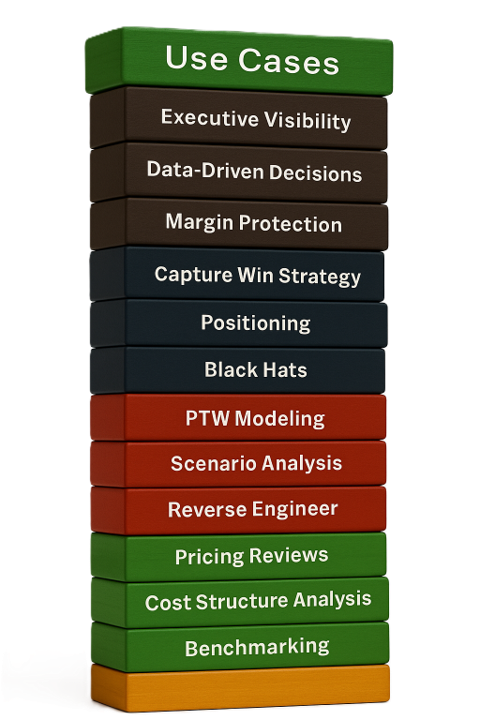

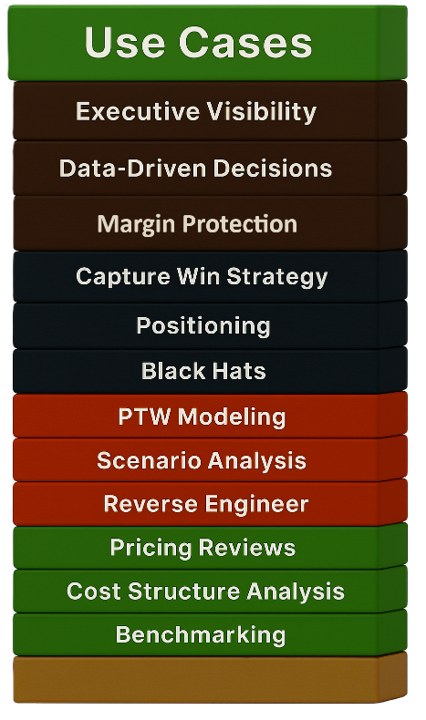

Empowering Capture, Pricing, and Strategy Leaders

In today’s competitive and cost-constrained GOVCON environment, strategic decisions demand precise, transparent, and role-specific insight. Whether you're shaping the bid strategy, building the pricing model, conducting a Black Hat, or guiding enterprise-level cost posture — wrap rates are a critical input to inform smart, data-driven choices.

Explore how each team leverages wrap rate intelligence to sharpen their competitive edge.

-

Use BlackFlag's wrap rate forecasts to inform Black Hat sessions, pricing strategy workshops, and executive reviews. Our detailed CAGE code models help you reverse-engineer how each competitor will structure their cost — enabling you to anticipate their likely bid posture and outflank them at the final gate.

-

Wrap rates built by actual finance professionals for finance professionals. Give your pricing team defensible models — not generic benchmarks. Calibrate fee and risk and refine assumptions using rate structures modeled with the same rigor as your own internal indirect rate calculations.

-

BlackFlag wrap rate packages integrate seamlessly into bottoms-up PTW analysis. Whether you’re pressure-testing your own bid or modeling a competitor’s response, our transparent, indirect rate breakdowns give you the detail and credibility required.

-

Understand how competitors’ rate structures compare and where you can differentiate. In a cost-sensitive environment, leadership needs visibility into how others are positioned — and where your pricing needs to land to win without eroding margin.

Wrap rates provide more than just pricing intelligence — they serve as a strategic benchmark for evaluating your own cost structure. In an era of tightening budgets and contract consolidation, executives use BlackFlag's data to assess whether their fringe, overhead, G&A, or fee components are competitive. As companies restructure or rebaseline for future growth, these insights guide rate realignment decisions, internal budgeting, and investment tradeoffs.

Whether evaluating a new pricing strategy or defending the status quo, wrap rates enable executives to lead with data, not assumptions.

Empowering Capture, Pricing, and Strategy Leaders

In today’s competitive and cost-constrained GOVCON environment, strategic decisions demand precise, transparent, and role-specific insight. Whether you're shaping the bid strategy, building the pricing model, conducting a Black Hat, or guiding enterprise-level cost posture — wrap rates are a critical input to inform smart, data-driven choices.

Explore how each team leverages wrap rate intelligence to sharpen their competitive edge.

-

Use BlackFlag's wrap rate forecasts to inform Black Hat sessions, pricing strategy workshops, and executive reviews. Our detailed CAGE code models help you reverse-engineer how each competitor will structure their cost — enabling you to anticipate their likely bid posture and outflank them at the final gate.

-

Wrap rates built by actual finance professionals for finance professionals. Give your pricing team defensible models — not generic benchmarks. Calibrate fee and risk and refine assumptions using rate structures modeled with the same rigor as your own internal indirect rate calculations.

-

BlackFlag wrap rate packages integrate seamlessly into bottoms-up PTW analysis. Whether you’re pressure-testing your own bid or modeling a competitor’s response, our transparent, indirect rate breakdowns give you the detail and credibility required.

-

Understand how competitors’ rate structures compare and where you can differentiate. In a cost-sensitive environment, leadership needs visibility into how others are positioned — and where your pricing needs to land to win without eroding margin.

Wrap rates provide more than just pricing intelligence — they serve as a strategic benchmark for evaluating your own cost structure. In an era of tightening budgets and contract consolidation, executives use BlackFlag's data to assess whether their fringe, overhead, G&A, or fee components are competitive. As companies restructure or rebaseline for future growth, these insights guide rate realignment decisions, internal budgeting, and investment tradeoffs.

Whether evaluating a new pricing strategy or defending the status quo, wrap rates enable executives to lead with data, not assumptions.

What a Wrap Rate is

Understanding the Metric That Shapes Competitive Pricing

A wrap rate is the fully burdened cost multiplier applied to direct labor to arrive at a company’s fully loaded labor rate. It includes all indirect cost components that “wrap around” base labor — typically:

Fringe Benefits

Overhead (OH)

General & Administrative (G&A)

Profit/Fee

Together, these components form a composite multiplier (e.g., 1.65x or 165%) that determines the cost to the Government for every hour of labor proposed. Understanding a competitor’s wrap rate — and how each element is structured — is essential to predicting their pricing behavior, especially in Firm Fixed Price (FFP) environments where every margin point matters.

Each BlackFlag Wrap Rate Package includes:

Forecasted Wrap Rate Breakdown by CAGE Code

Fringe, OH, G&A, Fee — each with modeled rationale

Trend Indicators

Where rates are moving and why

Competitor Peer Benchmarking

Compare side-by-side with up to 10 competitors

Financial & Strategic Posture Notes

Bid behavior indicators and scenario analysis

PDF + XLSX Deliverables

Executive-ready narrative plus editable data for your pricing and PTW teams

What You Receive

FAQs

-

A wrap rate is a multiplier applied to direct labor that captures all indirect costs and, in some cases, fee. It is commonly used in government contracting to translate an employee’s base salary into a fully burdened billing rate.

Cost Wrap: Includes Fringe, Overhead, and G&A applied to direct labor.

Price Wrap: A cost wrap plus Fee, representing the total multiplier used to bid labor on contracts.

At BlackFlag Advisors, our wrap rate analysis goes beyond the math — we provide context on competitor cost structures, fee targets, and benchmarking to show how aggressive (or conservative) a competitor’s pricing posture may be.

-

We account for that. Wraps are forecasted at the operating entity level, reflecting differences in business units, contract mix, and pricing posture when applicable.

-

Each wrap rate forecast is updated quarterly — or as material changes are observed (e.g., major restructuring, merger, significant award loss).

-

Absolutely. Every model includes full assumption transparency, source footnotes, and narrative rationale — so your team can validate and adjust for scenario modeling.

-

Click the Order button above or contact us at info@BlackFlagAdvisors.com.

Volume discounts are available.

All wrap rate products are developed using publicly available data and financial inference.