Indirect Reckoning: Relooking Cost Structures amid Budget Cuts & Competitive Realignment

If you manage pricing, FP&A, or indirects in a federal contracting shop, you’ve likely felt the tremor. Contract cancellations, staff reductions, and a dramatic shift in evaluation weighting are sending one loud message to the GOVCON finance community:

Relook your cost structure.

This isn’t theoretical. We’re watching contractors make hard pivots — shedding headcount, compressing G&A, and re-baselining their indirect pools — all to survive a market that is suddenly price-first, not value-first.

But the twist? Even as firms cut, the outlook remains uncertain — and that’s complicating the math behind every financial plan.

Two Catalysts Driving the Shift

1. Layoffs are gutting the labor base

The Department of Government Efficiency (DOGE) initiatives have already triggered over 3,750 layoffs across the industry — a conservative figure based on WARN Act data. That number likely undercounts the true impact, as:

Small businesses (<100 FTEs) aren't required to file under WARN

Layoffs from firms like Booz Allen (~2,500) and Deloitte (~3,000 estimated) haven’t been fully reported

Other sizable layoffs from large firms likely haven’t been fully reported either

These reductions aren’t just operational. They’re cost structural. Every departure shrinks the direct labor base over which G&A and Overhead must be recovered — and most of those costs don’t disappear with a pink slip.

2. Evaluation criteria are compressing toward price

We have already seen a change in evaluations and awards: Technical scores are converging, and price now often acts as the final discriminator.

That’s no longer theoretical — solicitations increasingly are explicityly demanding demonstrated cost savings, and even best-value evaluations are trending more like LPTA in practice. This puts pressure on finance to make room for aggressive pricing — even as fixed costs remain.

But What About the "Big Beautiful Bill"?

There’s another layer of complexity: the budget bill currently in motion — referred to as the “Big Beautiful Bill” — is expected to increase defense and border security spending while cutting social safety net programs. That means some growth markets may open up — especially in areas like COCOM support, autonomous systems, counter-UAS, and infrastructure.

But let’s be clear: uncertainty remains the defining characteristic of this market.

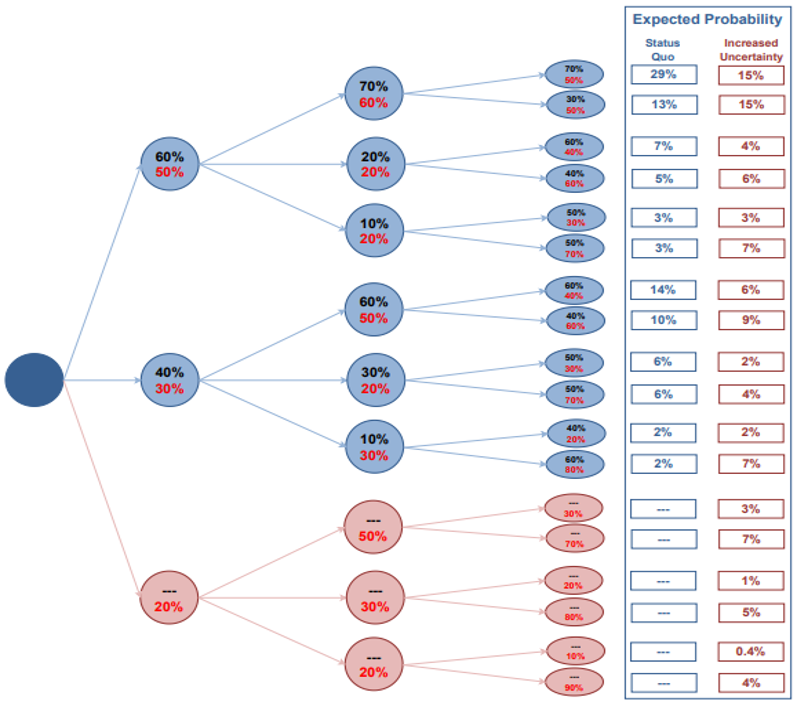

Disruption creates new possible outcomes. When those possibilities increase, the expected probability of revenue capture goes down. You might have 100% confidence in your booked revenue, 80% confidence in recompetes — but the probability of new capture has dropped due to delays, fewer COs, and evaluation risk. CFOs are recalculating revenue models under the weight of volatility.

The Mechanics: Why Indirect Rates Are Getting Crushed

Fringe benefits — predominantly — scale down with headcount. But G&A and Overhead don’t. That’s a problem.

Let’s assume a company cuts delivery staff and delays new hiring. Here’s what happens:

| Before Layoffs |

After Layoffs |

Delta | ||

|---|---|---|---|---|

| G&A Pool | $25M | $23M | (-$2M) | |

| Direct Labor Base | $250M | $150M | (-$100M) | |

| G&A Rate | 10.0% | 15.3% | +5.3% |

That’s a 53% increase in G&A rate — even after trimming costs. Now imagine trying to be price-competitive with that when there is little technical scores are flat across the board.

What This Means for Financial Strategy

From a indirect modeling perspective, everything has to shift:

Increased competition from aggressive bidders may dilute win probabilities and the expected value of new capture

The cost structure itself becomes a bid risk factor, especially in aggressive wrap rate environments

You may be modeling your competitors — but if your own indirect rates aren’t aligned with expected award pricing thresholds, you’ll end up priced out.

This is where finance has to partner directly with PTW and pricing teams to run bottoms-up scenarios that:

Model variable capture probabilities

Test multiple base scenarios

Identify the lowest survivable wrap rate for targeted captures

Final Thought

This market doesn’t reward certainty. It rewards adaptability. Whether the “Big Beautiful Bill” opens doors or not, whether your forecast adjusts upward or downward, the consistent truth is this:

Price is playing a more important role, and your indirects shape how competitive you can be.

For finance professionals in GOVCON, this is a strategic moment. Those who realign early will win. Those who wait for clarity may be left explaining why they didn’t pivot when they had the chance.

At BlackFlag, we can help you understand how your competitors are positioned — and provide benchmarks so you can reassess your indirect structure with confidence.